Synchrony Cd Rates Highest

You can access your money in your High Yield Savings and (non-IRA) Money Market accounts these ways:

Synchrony Cd Rates Highest

You can access your money in your High Yield Savings and (non-IRA) Money Market accounts these ways:

- ATM: With the optional ATM card available with a High Yield Savings or Money Market account, you can get cash and perform basic transactions either in the U.S. or abroad, at any ATM displaying the Plus or Accel logos. Synchrony Bank currently doesn’t charge a fee to use an ATM, but there may be an ATM fee charged by the ATM owner/operator. Synchrony Bank will refund domestic ATM fees charged by other financial institutions, up to $5 per statement cycle. If you have Diamond status in our Perks Rewards program, you’ll receive unlimited ATM fee refunds each statement cycle. (Fees associated with using an ATM machine abroad, such as currency conversion and foreign transaction fees, are not refundable by Synchrony Bank.)

- Electronic transfer:You can transfer your money to and from accounts you hold at Synchrony and other banks. Just sign in to synchronybank.com. You can also use our automated phone system by calling 1-866-226-5638 anytime. We do not charge a fee to transfer funds to and from your High Yield Savings and Money Market accounts.

- Check: You can optionally request checks for your Money Market account.

- Wire transfer: Request a wire transfer from your High Yield Savings or Money Market account by calling 1-866-226-5638 from 7 a.m. to midnight ET Monday–Friday, or 8 a.m. to 5 p.m. ET Saturday–Sunday.

Information on Synchrony Bank 2 Year CD Rates: When deciding the interest rates for their CD rates, Synchrony Bank like other US banks and credit are dependent on monetary policy decisions which are provided by the Federal Reserve or 'The Fed'. Bob saving account interest rate comparison. 2 Year terms are considered to be a medium or intermediate term investments and when Synchrony sets.

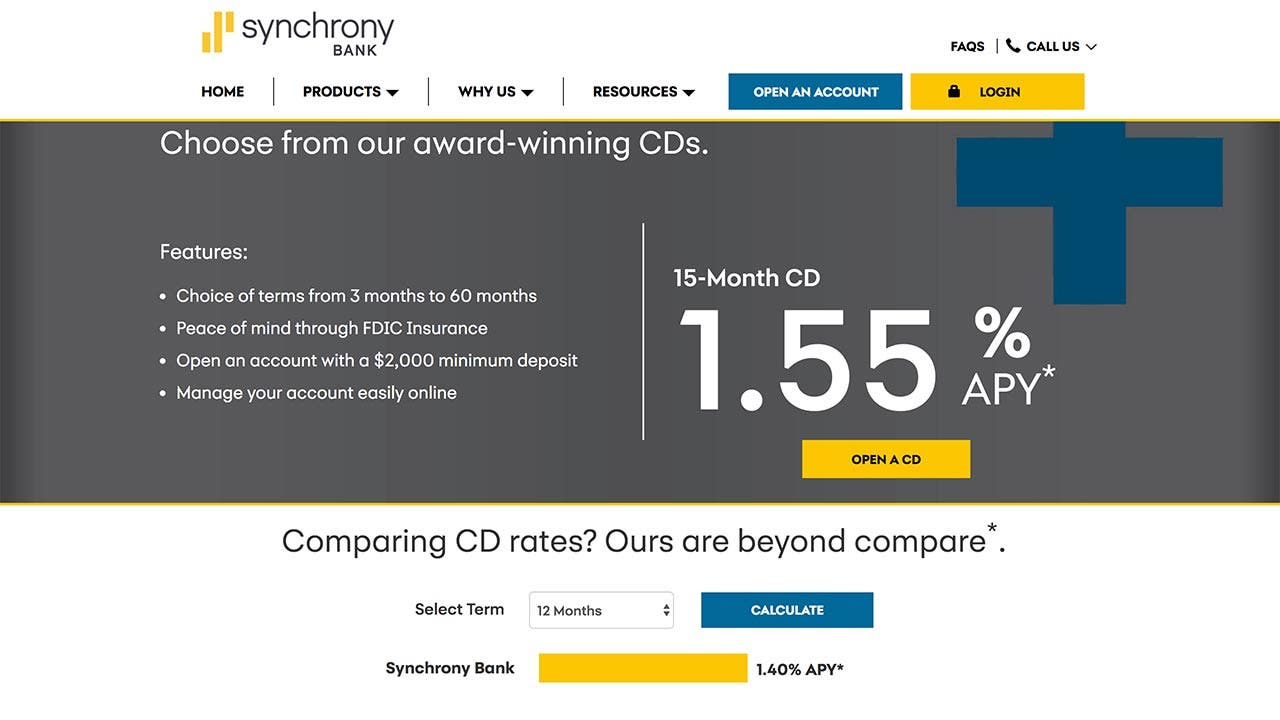

Synchrony Cd Rates As Of Today

Cardschat $100 daily freeroll password americas cardroom. Synchrony offers a wide range of CD terms. The minimum deposit for each CD is $2,000. Synchrony is best for savers who are comfortable banking only online. Synchrony Bank earned 4.2 out of 5 stars. Overview of Synchrony CDs. Synchrony’s CD accounts are pretty standard without any extra perks or benefits. Of course, the high-earning CD rates certainly make up for that since you’ll see some excellent growth by the time your account reaches maturity. Keep in mind that Synchrony CDs require at least $2,000 to open. Synchrony’s CDs offer competitive interest rates on terms that range from 3 to 60 months. While these rates are well above the national average, they aren’t the best on the market. Remember, when you deposit your money in a CD you can’t access it until the term is up.